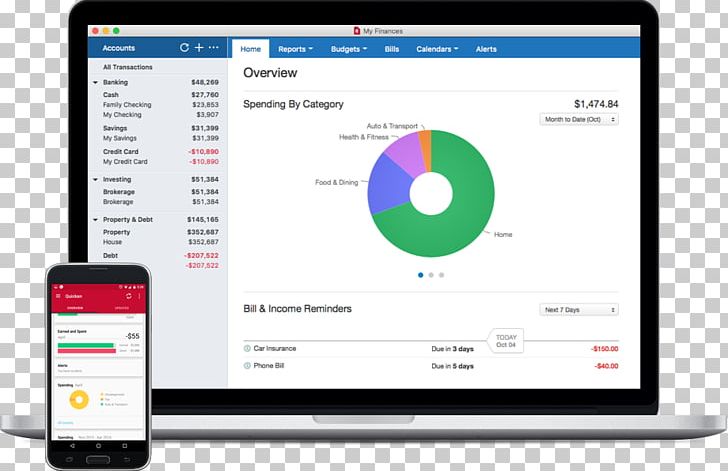

#QUICKEN PERSONAL FINANCE SOFTWARE#

Therefore, financial software programs offer a more even platform for us to build on. Remember, very few are innately good at managing money, and even those of us who try often find ourselves in a sea of numbers. The best way for most people to start a formal money management plan is by using software programs like Quicken that help take the guesswork out of the process. How Can Financial Software Programs Help Personal Finances?Īccording to the writers at NerdWallet, a financial plan is “a comprehensive picture of your current finances, your financial goals, and any strategies you’ve set to achieve those goals.” It is the way to reduce stress where money is concerned. We’ll also look into everything from the importance of budgeting and why we may struggle with it, to how personal finance software programs help create and maintain budgets.

#QUICKEN PERSONAL FINANCE FREE#

This article will discuss the critical differences between Quicken and QuickBooks and explore free alternative financial platforms. Although both software programs share many of the same features, most of the capabilities QuickBooks provides are not needed by personal finance users.

Quicken is better than QuickBooks for personal finance since it is designed specifically for this purpose, whereas QuickBooks is for small business owners. The good news is that there are several resources to help in that area, and two of the most widely known products are Quicken and Quickbooks, but which should you choose? However, these things are easier said than done, and financial planning can be overwhelming to most. Sadly, many Americans are experiencing hardships today, exposing that there is never a better time than right now to begin taking control of our finances and planning for our future. Please check out my disclosure page for more details. This post may contain affiliate links to products that I recommendĪnd I may earn money or products from companies mentioned in this post.

0 kommentar(er)

0 kommentar(er)